The Rising Demand for Quality Benefits in Today’s Job Market

In today’s competitive job market, employees are no longer just seeking a paycheck—they’re increasingly pursuing employers who offer comprehensive, quality health benefits they can afford. From health insurance to wellness programs, the benefits package has become a critical factor in job decisions. But what are employees really looking for?

Employees Expectations for Health Benefits

With 89% of American workers preferring employer-sponsored health coverage and 95% valuing its convenience1, it’s clear that the right benefits can make or break your ability to attract talent. In fact, 41% of Indeed job postings in May 20242 highlighted employee benefits as a key feature. And, as the demand for quality benefits continues to rise, employers who fail to adapt may risk falling behind or losing talent.

In a market where employee satisfaction drives recruitment and retention, fostering a positive experience is essential to staying competitive. Glassdoor reports that employee feedback is three times more trusted than a CEO’s2. Negative brand perception can deter potential hires, as candidates increasingly rely on review platforms to assess a company’s work environment and benefits.

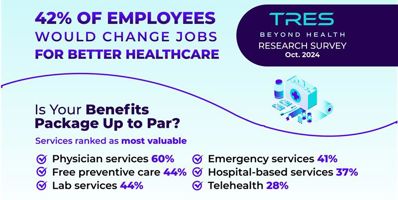

For employers, offering health benefits can be more than simply a compliance concern—it can be a strategic advantage. A recent survey commissioned by Tres Health and conducted by Talker Research found that while seeking employment, 73% of Americans say that access to quality healthcare options is a key factor in their decision-making process, so much so, that 66% would likely mention it in an interview.3 This further solidifies that companies with comprehensive health plans are better positioned to attract top talent.

What Employees Want

Aside from quality, employees also want a health plan they can afford, as 42% of survey respondents said they would only be able to contribute an additional $100 a month toward better benefits, as the cost is already too high. And, when asked what features they are looking for the most, they stated healthcare with low-deductibles, low or no co-pay, low premiums, and lower prescription drug costs. However, 42% said they feel their employer only offers the bare minimum for health insurance options. So where do employers go from here?

Finding benefit plans that focus on services employees are more likely to use, rather than benefits that cover every broad service, can help reduce costs. Some Minimum Value Plans (MVPs) and Minimum Essential Coverage (MEC) plans may be a great option for this. For example, employees surveyed revealed they need a health plan that covers physician services, preventive care, emergency services, and labs, with options for telemedicine. Focusing on these key services, and making those benefits richer, can lower overall plan costs for the member.

Finding the Balance

As Q1 hiring budgets are being finalized, it's important to assess whether your employee benefits meet the expectations of today's job seekers. With candidates placing more value on quality benefits than ever before, what you offer could be the key to attracting and retaining top talent in 2025. MEC and MV plans may be helpful to find the balance between offering affordable options and quality coverage on the most utilized services.