The Affordability Threshold and Its Impact on Alternative Health Plans

As 2025 approaches, employers offering health plans must remain attentive to the Affordable Care Act (ACA) regulations, and any new changes, including updates to the affordability threshold set by the IRS. For health plan program managers and third-party administrators (TPAs) providing alternative health plans, understanding these thresholds is key to helping clients stay compliant and manage their employee benefits effectively.

What is the ACA Affordability Threshold?

Under the ACA, large employers must offer affordable health insurance coverage to their full-time employees. A health plan is deemed affordable, but the IRS, if the employee's required contribution for self-only coverage does not exceed a certain percentage of their household income. For 2025, the IRS affordability threshold has been updated to 9.02%, a slight increase from 2024’s threshold, which was 8.39%.

This percentage is vital because failure to meet affordability standards can trigger employer-shared responsibility penalties. Employers who don’t comply with this rule may face costly financial penalties if even one full-time employee purchases coverage through the Health Insurance Marketplace and receives a premium tax credit.

Considerations for Employers

As employers prepare their benefit plans for the upcoming year, it’s important to ensure that the employee portion of the premium (for self-only coverage) does not exceed the threshold percentage. Employers can use one, or more, of the three approved “safe harbors” to determine whether their health plans meet the affordability requirement based on the specific financial circumstances of their workforce, including Form W-2, rate of pay, or the federal poverty line.

Penalties for failure to offer an affordable plan can vary based on whether it’s a failure to 1) offer coverage to 95% of employees or 2) meet affordable Minimum Value (MV) coverage.

Employers must make certain their health coverage meets minimum essential standards and covers at least 60% of total allowed costs. Additionally, benefits must provide coverage for physician and inpatient hospital services. Failure to meet these requirements or inconsistencies in coverage can result in further penalties.

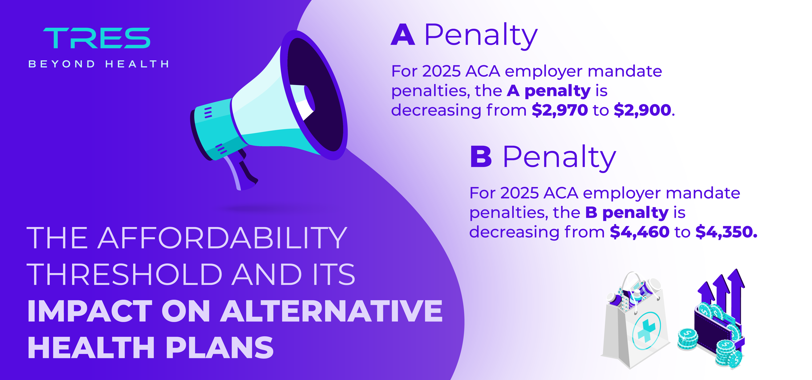

Penalty A and B Changes for 2025

For the first time, penalties are decreasing for employers, but just slightly. Penalty A will decrease from $2,970 in 2024 to $2,900 in 2025. This penalty relates to an employer failing to offer minimum essential coverage to 95% of full-time, benefit-eligible employees. Penalty B will decrease from $4,460 in 2024 to $4,350 in 2025. This penalty relates to an employer failing to provide affordable MV coverage to benefit-eligible employees.

While Penalty A has a lower per-employee rate, it can result in a significant total penalty because it is applied across the entire workforce. For example, if a company with 400 full-time employees in 2025 fails to provide Minimum Essential Coverage to at least 95% of its employees and their dependents, and one employee receives a Premium Tax Credit (PTC) for 12 months, the total penalty could amount to $1,064,400.

Employers should carefully review their health plan offerings to avoid triggering penalties. Alternative health plan models may offer solutions due to their flexible plan designs, reference-based pricing options, and direct primary care solutions, which could help lower overall costs while still providing affordable, high-quality care for employees.

Health Plan Compliance for 2025

As we get closer to 2025, the IRS ACA affordability threshold is an important factor for employers to consider when designing their health plans. For those utilizing alternative health plan models, it's crucial to ensure contributions stay within the required limits.

Although the ACA has expanded coverage to millions who previously lacked access, many enrollees in marketplace plans still face high out-of-pocket costs, including deductibles, coinsurance, and copayments. These affordability challenges can significantly impact access to care and financial stability. Alternative health plans may be a viable option for employers when traditional routes have been too complex or costly. There are solutions out there that can help these groups, especially small employers, remain compliant, while also delivering meaningful benefits.

Sources:

Federal Register :: Shared Responsibility for Employers Regarding Health Coverage

Using Affordability Safe Harbors to Avoid ACA Penalties (hrp.net)

https://workforce.equifax.com/aca-calculator#ACA-penalties-calculator__form